Europe is suffering from a huge hangover after the tech investment party of 2020-2021. That said, compared to pre-pandemic levels, VC investment in European startups is up, historically speaking, and reached $60 billion, according to a new report. However, the volatility of increased investment over the pandemic has stood in stark contrast to that development and has created significant headwinds, although there are signs of “green shoots”.

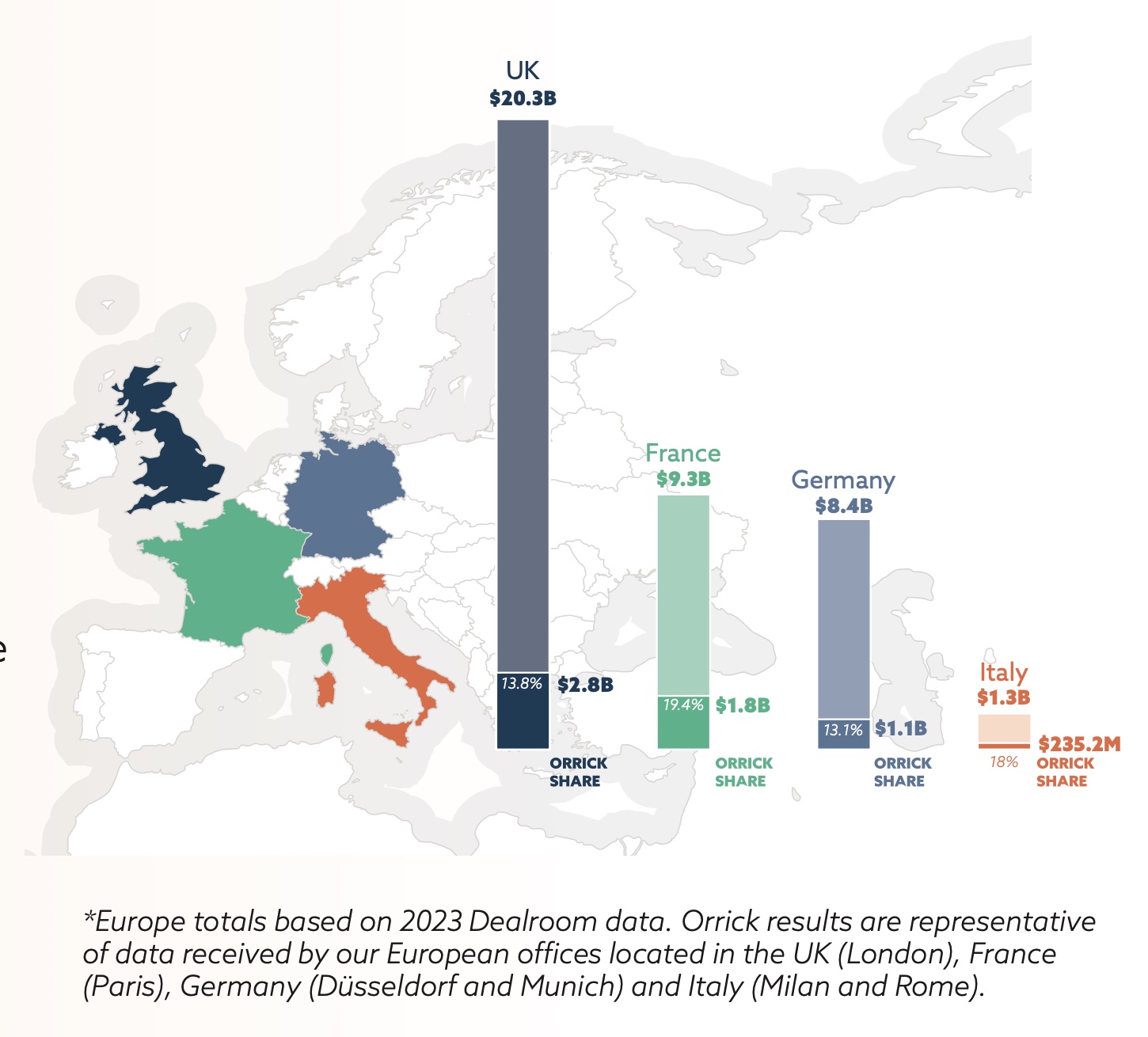

Global law firm Orrick analyzed more than 350 VC and growth equity investments its clients completed in Europe last year.

Total capital raised in Europe was $61.8 billion. 2023 marks a reset and major correction in investment levels globally. Of the top 3 global regions for VC – Europe, Asia and North America – Europe is the only one that increased in 2023 from 2019 levels.

According to the report, Europe is sitting on “record levels of dry powder” and “produces more new founders than the United States”, the fund remains sluggish.

Just 11 new unicorns emerged from Europe last year, the lowest in a decade, and an increasing number of unicorns are losing their status.

Climate technology has overtaken FinTech as Europe’s most popular sector

AI’s share of total investment in Europe rose to a record high of 17% 5.

Orrick found that investors – motivated by a drop in funding – are ‘flipping the scotch’, exercising more control over investments, with founders required to stand behind guarantees in 39% of venture deals.

There was a clear decline in later-stage financing, deal volume declined, and founders have turned to other strategies such as alternative financing methods, or revenue and profitability.

There was an “unprecedented spike” in the ability of new investors to enter tech, as founders sought new lead investors, and an “uptick” in convertible loans, SAFEs and ASAs, with convertible financing representing 23% of rounds in 2023.

Investors were generally focused on managing their existing portfolios, secondary transactions increased, and SaaS and AI became popular. Interestingly, the number of FinTech investments decreased.

European 2023 Tech Investment Deal (Orick)

At each stage, the value of the deal is reduced, with the most dramatic decline in later stage deals.

Early-stage deal prices dropped by 40%, although early-stage investors are still very active.

There was a decline in ‘mega rounds’ over $100M+. However, the IPO landscape showed “signs of life” with ARM’s $55 billion IPO, and M&A activity showing “green shoots.”

In the UK, VCs are under pressure to deliver returns, which is likely to fuel secondary, greater M&A activity and demand for consolidation.

In France there has been a shift from ‘founder-friendly’ terms to more investor-friendly terms, unlike in the UK, where the opposite is true.

In Germany, increased demand for liquidity from LPs is expected to “stimulate the tech M&A pipeline.”