We’re still years away from breaking physical quantum computers into the market at any scale and reliability, but don’t give up on deep technology. The market for advanced quantum computer science — which applies quantum principles to manage complex calculations in areas such as finance and artificial intelligence — appears to be accelerating.

In the latest development, a startup from San Sebastian, Spain called Multiverse Computing is announcing that it has raised €25 million (or $27 million) in an equity funding round led by Columbus Venture Partners. The funding, which has an initial value of €100 million ($108 million), will be used in two main areas. The startup plans to continue building its existing business by working with startups in verticals such as manufacturing and finance; And it wants to make new efforts to work more closely with AI companies and those building big language models.

In both cases, the pitch is the same, CEO Enrique Lisaso-Olmos: “Improvement.”

In other words, as computing becomes more advanced, it can become more expensive and in some cases too complex to implement continuously. Multiverse’s pitch is that its software platform Singularity — designed for applications across industries such as finance, manufacturing, energy, cybersecurity and defense — can be used to make complex modeling and forecasting applications more efficient. To operate and improve the method.

In AI, there is a growing focus on implementing a platform to compress large language models, a new product called CompactifAI is focusing on the computations that are continuously performed when building LLMs and Interrogation is done to eliminate excess noise and speed up the work. (and thus reliability) when generating results.

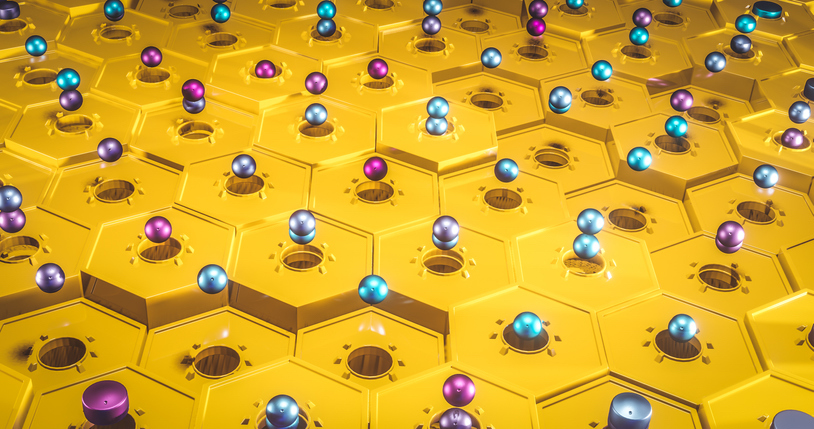

The company claims it can compress LLMs by more than 80 percent with the software “with a quantum-inspired tensor network,” while still producing accurate results. If true, this could change how companies buy and use processors, addressing one of the biggest hurdles in the industry today.

Lizaso-Olmos cuts the profile of a polymath who began his career more than 30 years ago, first qualifying as a medical doctor, then earning a second degree in mathematics, and then a third with a PhD in computer engineering. , who somehow linked these things together, a Ph.D. in biostatistics. He then did an MBA, he said. Throughout these conversations he picked up like-minded thinkers and friends, and some of them—namely Roman Oris and Samuel Miguel—were interested in the concept of quantum software and were already making a name for themselves through academic work around the topic. .

“Multiverse started in a WhatsApp group,” he jokes. The year was 2017, and for a thought experiment, some of them thought it would be “fun” to write a scientific paper about what you can do with quantum in finance.

The paper ended up being accepted for a conference at the University of Toronto, so they went with it. Arriving, Lisaso-Olmos found the paper being shared and discussed around and suddenly began to see that people might use it as inspiration for entrepreneurial ambitions. That’s when Lisaso-Olmos’ MBA-radar kicked in and she got two of her friends together for a serious IRL chat.

And so they, along with Alfonso Rubio, started multiverse computing.

This early exploration of the quantitative and financial technology that was the subject of that paper became the company’s first commercial application, and where it gained its first traction. It has since expanded into other sectors and counts Moody’s Analytics, Bosch, BASF, Iberdrola, Credit Agricole and BBVA among its clients, and Lizaso-Olmos says, as well as industrial and energy clients, which Love the green parts of more efficient computing. , today actually accounts for more than the company’s business.

Along with Columbus, previous backer Quantonation Ventures was also joined by new backers such as the European Innovation Council Fund, Redstone QAI Quantum Fund, and Indi Partners.

“Multiverse’s extraordinary team will soon apply its unparalleled ability to deliver quantum and quantum-inspired software solutions to the life sciences and biotechnology markets as well, where Columbus Venture Partners will identify unmet market needs and high-profile industrial partners.” will help,” Javier Garcia, a partner at Columbus Venture Partners, in a statement.

While the pitch to the vertical seems to be connected to customers, what remains to be seen is how the goal of moving forward on a level, deep tech and AI companies to target themselves, may play for the multiverse. Other Alphabet spin-outs competing in the same space include Sandbox AQ, Quantum Motion, and Classiq.